Fill in your basic personal details

Upload documents like PAN, Aadhaar, cancelled cheque

The Demat & Trading account is activated post verification

Unlock more ways to trade and invest with these powerful features:

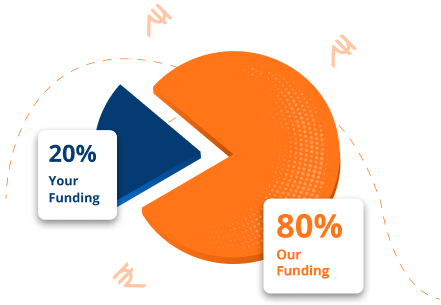

Get funding up to 4X your investment and enjoy unlimited holding period

Get instant margin by pledging your holdings for low-cost trading and investing

Buying and selling stocks within the same trading day

Buying stocks and holding them in their demat account for long term

Buying and selling stocks within days or weeks to benefit from short- to medium-term price trends

Long-term trading based on fundamental analysis and historical data

Quick trades based on price gaps or market trends for gains within a few minutes

Trading stocks that show strong upward or downward trends

Buying or selling futures and options to hedge risks or speculate on price movements

Trading using programs, models and APIs to execute orders based on pre-set criteria

We are Business Partners with Mirae Asset Sharekhan to bring you the best in equities — here’s how…

World-class research and analysis.

Advanced trading platforms for seamless investing.

A legacy of trust and reliability.

Global presence across 19 markets

$600+ billion in assets under management (AUM)

Global leader in Exchange Traded Funds (ETFs)

Equity investments offer multiple benefits, making them one of the best ways to grow your wealth

High Potential Returns Historically, equities have delivered 12–15% annual returns over the long term, outpacing most other investment options.

Dividend Income Earn additional income through dividends while your investments grow.

Diversification Spread your risk by investing in a variety of companies across sectors.

Liquidity Easily buy or sell your shares whenever you need to.

Equities, or company shares, represent ownership in a business. They can be bought or sold in the stock market, giving investors a chance to participate in a company’s growth.

Over the past few decades, equities have become one of the most effective ways to build wealth in India. Thanks to the power of compounding—often called the “Eighth Wonder of the World”—long-term equity investing has rewarded many investors. Today, India has a thriving equity trading ecosystem.

However, multiplying wealth through equities requires knowledge, discipline, and experience. That’s why most investors prefer trading through the stock market. With an equity trading account, you can easily buy and sell company shares, opening the door to long-term financial growth.

Questions on your mind? Dont worry we have the answers!

We’re here to help you, Monday to Saturday, 9:30 AM – 6:30 PM.